Back

23 Oct 2018

GBP/USD Technical Analysis: Tumbling into 1.2950 as bears get brave, downside channel holding

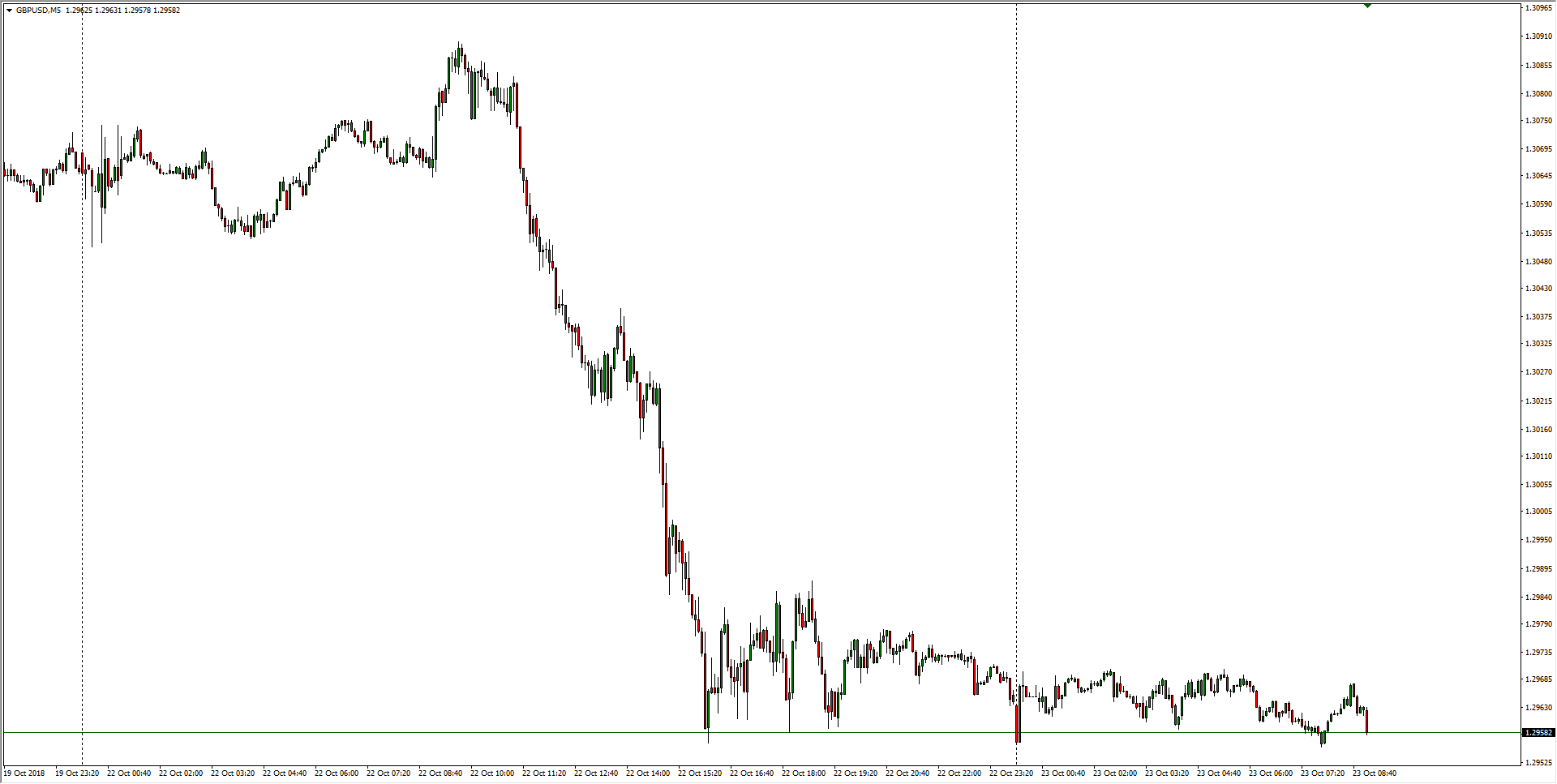

- The past twenty-four hours have seen the GBP/USD trading into the basement after slipping from yesterday's peak of 1.3090 in a last-ditch attempt to recover the 1.3100 major handle, but the Sterling couldn't find the bullish drive as Brexit headlines continue to erode investor confidence in the Pound, and the Cable is now accelerating its bearish momentum.

- GBP/USD analysis: the end of a Brexit deal hopes?

GBP/USD, M5

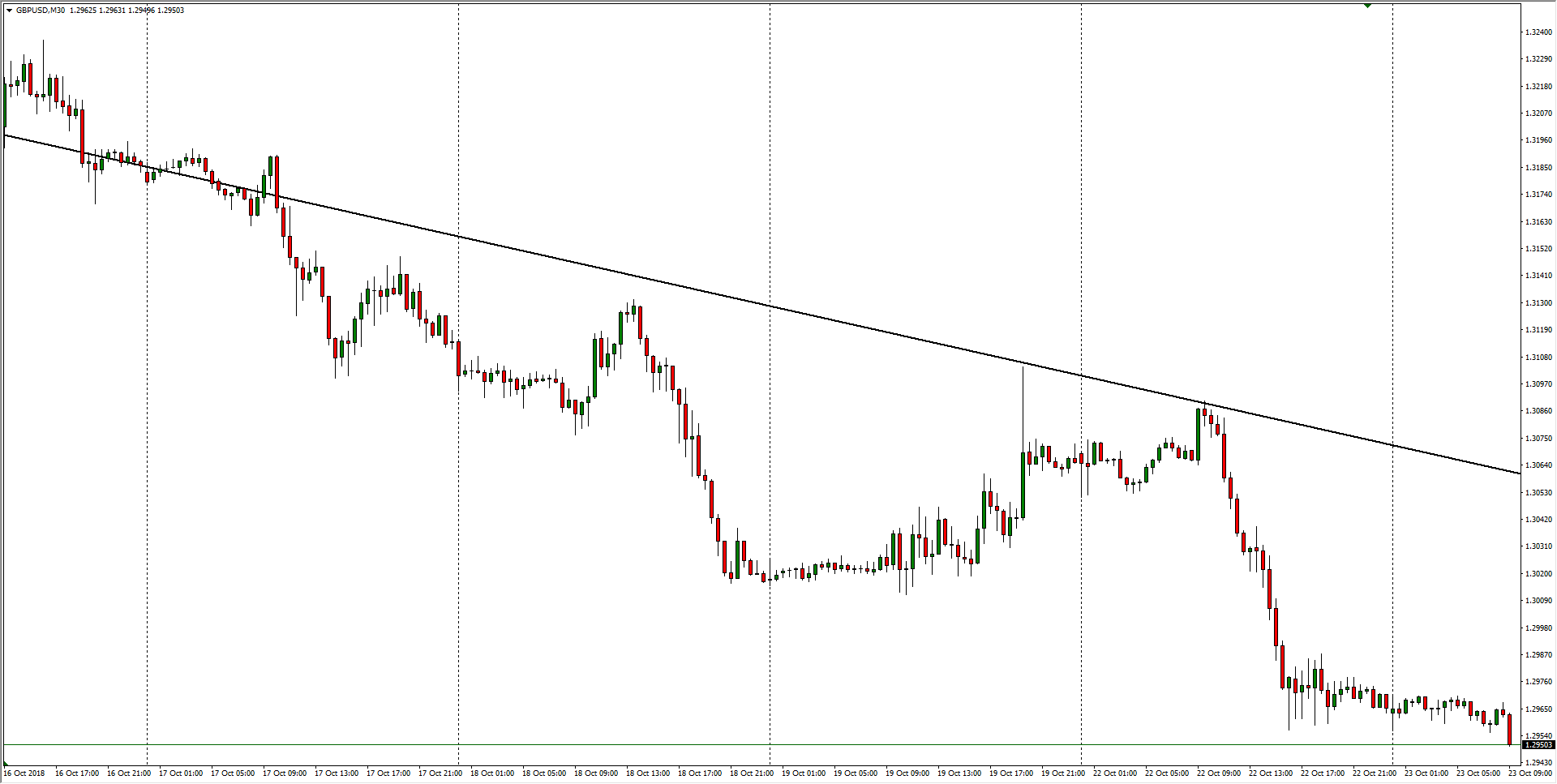

- The previous trading week sees the Cable maintaining downside momentum, clipping steadily down beneath a descending trendline, and GBP/USD buyers are moving out of the way as shortsellers push the pair into 1.2950.

GBP/USD, M30

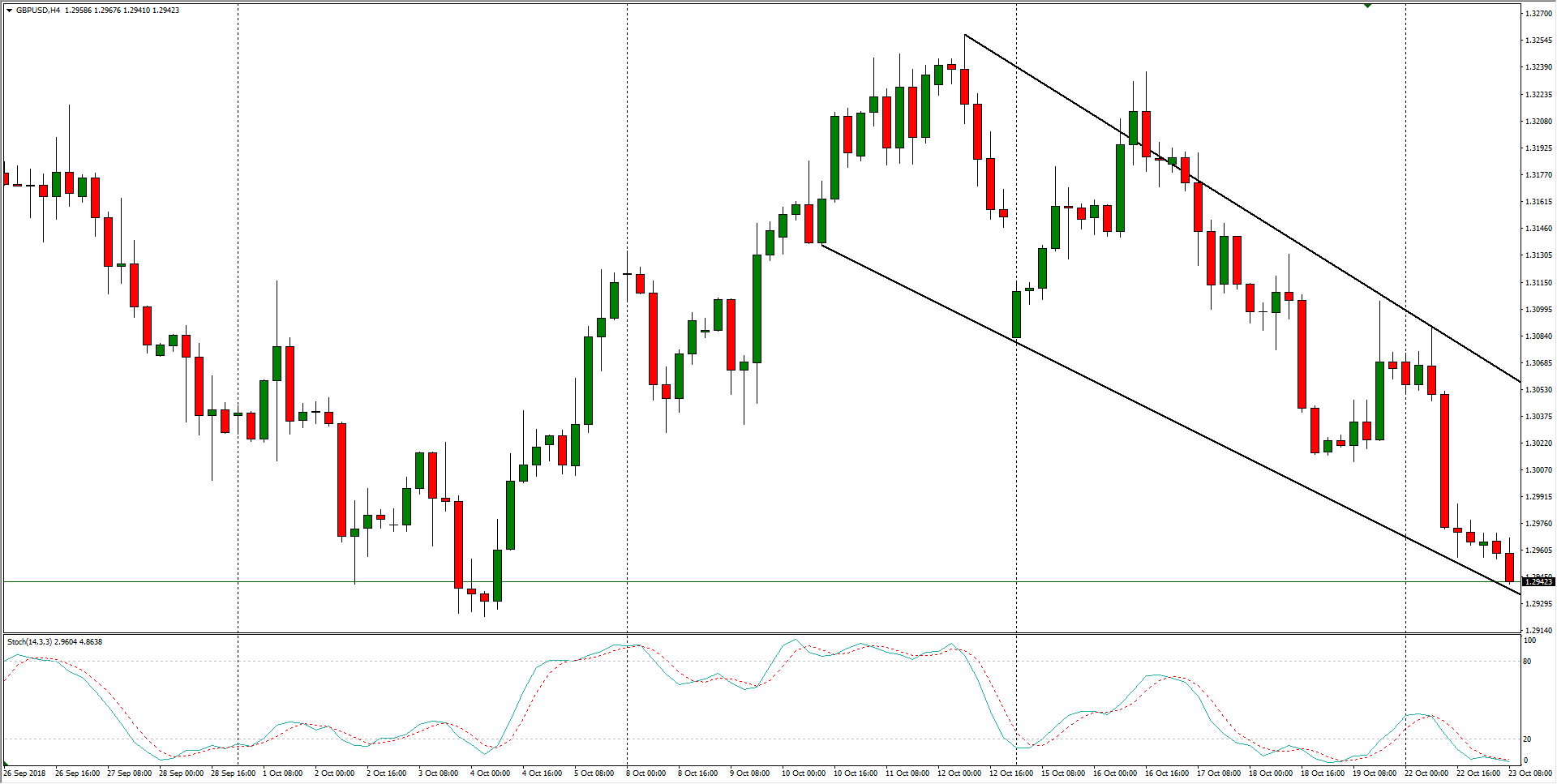

- Looking back over the past month, the Cable is threatening to fall out the bottom side of a declining channel, but support threatens the current downside move from 2018's technical bottom at 1.2922.

GBP/USD, H4

GBP/USD

Overview:

Last Price: 1.2963

Daily change: -5.0 pips

Daily change: -0.0386%

Daily Open: 1.2968

Trends:

Daily SMA20: 1.3094

Daily SMA50: 1.3009

Daily SMA100: 1.3088

Daily SMA200: 1.3477

Levels:

Daily High: 1.3092

Daily Low: 1.2956

Weekly High: 1.3238

Weekly Low: 1.3011

Monthly High: 1.33

Monthly Low: 1.2786

Daily Fibonacci 38.2%: 1.3008

Daily Fibonacci 61.8%: 1.304

Daily Pivot Point S1: 1.2919

Daily Pivot Point S2: 1.287

Daily Pivot Point S3: 1.2784

Daily Pivot Point R1: 1.3054

Daily Pivot Point R2: 1.314

Daily Pivot Point R3: 1.3189