Back

19 Oct 2023

Crude Oil Futures: Corrective move seems likely near term

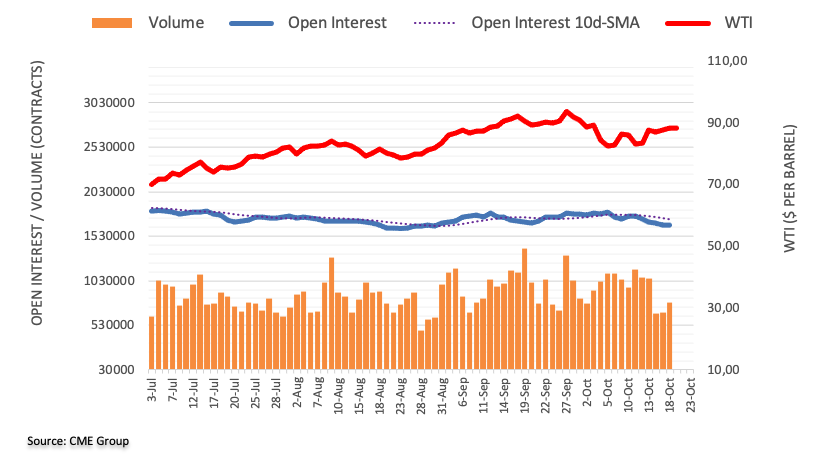

Considering advanced prints from CME Group for crude oil futures markets, open interest shrank for the fifth consecutive session on Wednesday, now by around 2.8K contracts. Volume, instead, went up for the second straight session, this time by more than 115K contracts.

WTI: Upside momentum appears limited around $95.00

WTI prices added to Tuesday’s advance and flirted with the key $90.00 mark per barrel on Wednesday. The daily gains were on the back of shrinking open interest, however, and seem to favour some corrective knee-jerk in the very near term. On the upside, the 2023 high around the $95.00 mark per barrel (September 28) remains the next barrier for bulls for the time being.