Gold Price Forecast: XAU/USD bears eye downside breakout of tight structure

- Gold price bearish while below $2,000 and the 61.8% around $1,992.

- Despite poor data, US Dollar stronger, making gold more expensive for international buyers.

Gold price was ending flat on the day in choppy trade while the US Dollar and bond yields climbed a touch following the weaker-than-expected first-quarter Gross Domestic Product

At the time of writing, the Gold price is trading around $1,987.80 and has traveled between a low of $1,974.11 and $2,003.41 following data that showed inflation was stronger than anticipated helping the US 10-yr Treasury note to rally 8bp to 3.53%, bearish for gold since it offers no interest. The US two-year note was last seen paying 4.080%, up 14.4 basis points.

The US Dollar was also stronger, making gold more expensive for international buyers. The ICE dollar index was last seen up 0.06 points to 101.53.

In the data, the United States on Thursday reported its GDP rising by 1.1% in the first quarter, the third-straight quarterly rise but under the consensus estimate for a 2% rise. However, the core inflation measure lifted 4.9%.

Meanwhile, the Federal Reserve´s policy committee is expected to raise interest rates by 25 basis points when its two-meeting ends next Wednesday. ´´WIRP suggests nearly 80% odds of 25 bp hike at the May 2-3 meeting, down from 90% at the start of this week and back to the 80% at the start of last week. We continue to believe that a 25 bp hike next week is a done deal,´´ analysts at Brown Brothers Harriman explained.

´´Between the May 2-3 and June 13-14 meetings, the Fed will have digested two more job reports, two CPI/PPI reports, and one retail sales report. At this point, a pause in June might just be the most likely outcome but it really will depend on how all that data come in,´´ the analysts explained.

Meanwhile, analysts at TD Securities argued that ´´discretionary traders are still sitting on the sidelines, which suggests cuts pricing is still not feeding through to interest. In the near term, weaker longs still remain vulnerable, but we don't expect the first selling meaningful program to kick in until prices break $1,964 in gold.´´

Gold technical analysis

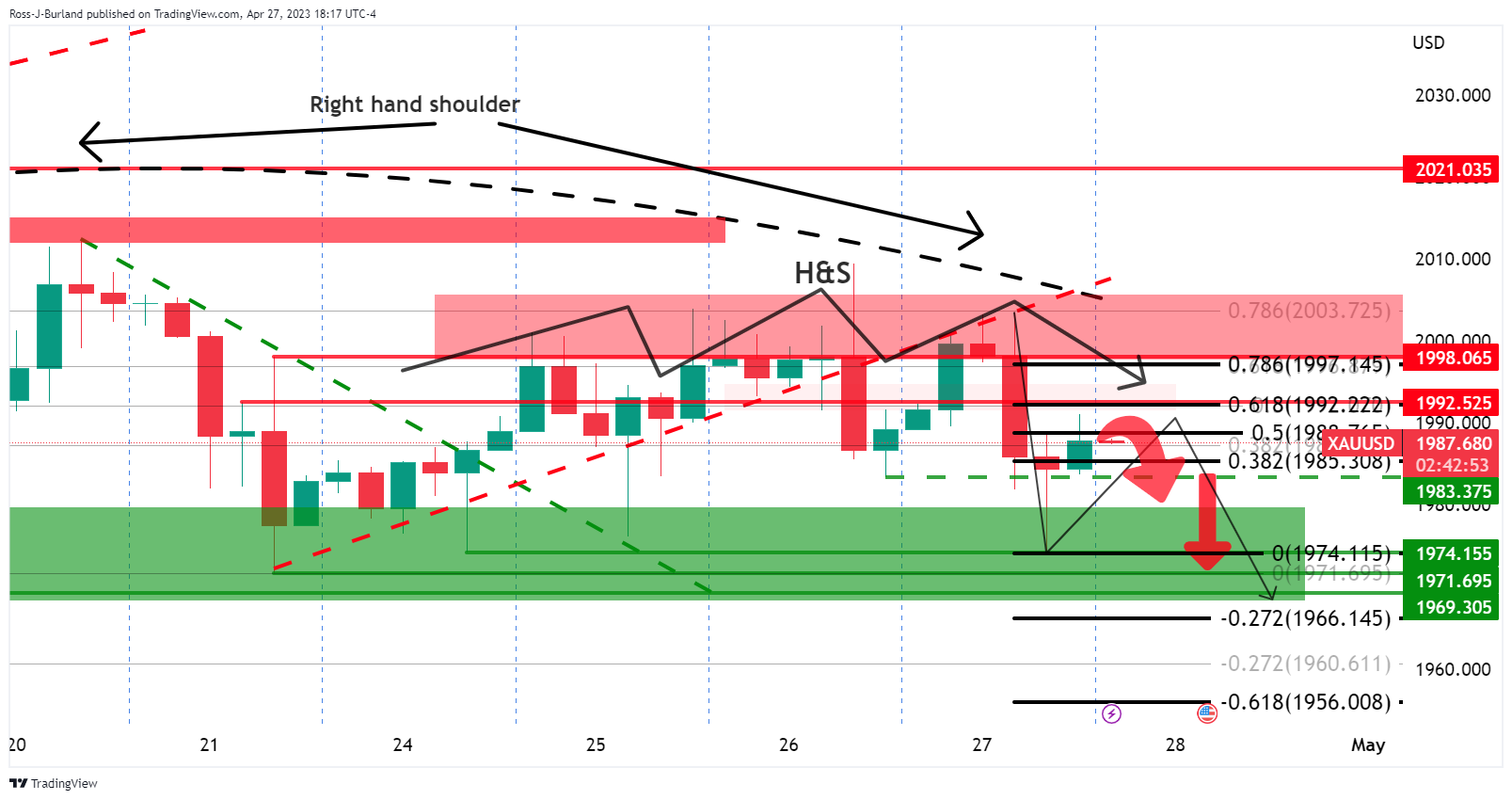

Gold price has been topping out on a number of attempts to stay above $2,000 but bears keep showing up. We now have a potential peak formation here on the 4-hour chart within the right-hand shoulder. Zooming in, we have another head and shoulders:

The bias is very much bearish while below $2,000 and the 61.8% around $1,992.